Condo Insurance in and around Severn

Get your Severn condo insured right here!

Insure your condo with State Farm today

Your Search For Condo Insurance Ends With State Farm

Because your condo is your retreat, there are some key details to consider - location, future needs, size, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you excellent coverage options to help meet your needs.

Get your Severn condo insured right here!

Insure your condo with State Farm today

Condo Coverage Options To Fit Your Needs

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has plenty options to keep your largest asset protected. You’ll get coverage options to match your specific needs. Thank goodness that you won’t have to figure that out alone. With personal attention and remarkable customer service, Agent Marie Waring can walk you through every step to help build a policy that protects your condo unit and everything you’ve invested in.

If you're ready to bundle or find out more about State Farm's fantastic condo insurance, visit agent Marie Waring today!

Have More Questions About Condo Unitowners Insurance?

Call Marie at (410) 551-4666 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

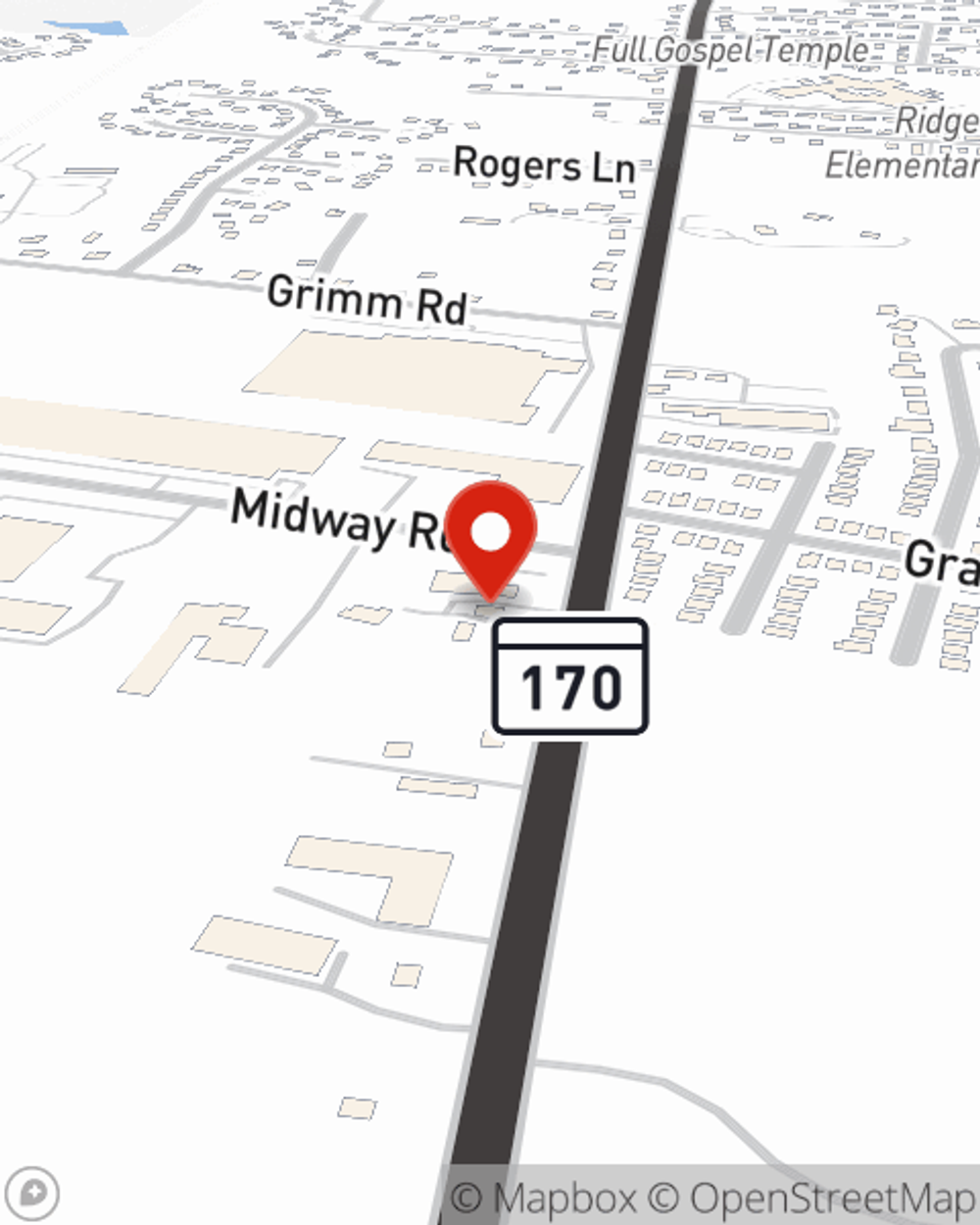

Marie Waring

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.